Accessory Dwelling Units in Atlanta offer compelling investment opportunities for property owners seeking to maximize their real estate returns. This comprehensive analysis examines the financial performance of ADU investments across Atlanta metro area, including Fulton County and DeKalb County markets.

Atlanta ADU Investment Landscape

Atlanta's robust economy, growing population, and housing affordability crisis create ideal conditions for ADU investments. The city's tech boom, major corporations, and universities drive consistent rental demand, while zoning reforms have expanded ADU opportunities throughout the metro area.

ADU investments in Atlanta typically outperform traditional real estate investments through multiple revenue streams: rental income, property value appreciation, and tax advantages. Understanding the complete financial picture helps property owners make informed investment decisions.

| Investment Metric | Atlanta ADUs | Traditional Rental | Stock Market |

|---|---|---|---|

| Annual Cash Return | 8-15% | 6-10% | 7-10% |

| Property Appreciation | 4-7% | 3-5% | N/A |

| Total Return Potential | 12-22% | 9-15% | 7-10% |

| Tax Benefits | High | Medium | Low |

Why Atlanta ADUs Excel

Atlanta's combination of strong job growth, limited housing supply, and progressive ADU policies creates a perfect storm for investment success. The city's diverse economy and growing tech sector ensure consistent tenant demand across multiple income levels.

Rental Income Analysis by Neighborhood

Atlanta's diverse neighborhoods offer varying rental income potential for ADU investments.

Premium Neighborhoods (Buckhead, Virginia Highland, Inman Park)

High-end areas command top rental rates with affluent tenant pools:

- Studio/1BR ADUs: $1,800-$2,800/month

- 1BR+ ADUs: $2,500-$4,000/month

- Gross rental yield: 6-10% annually

- Tenant profile: Young professionals, executives, students

- Vacancy rates: Low (2-5% typical)

- Appreciation potential: Strong long-term growth

Mid-Tier Neighborhoods (Decatur, East Atlanta, Grant Park)

Emerging areas offer strong rental demand with appreciation upside:

- Studio/1BR ADUs: $1,400-$2,200/month

- 1BR+ ADUs: $1,800-$2,800/month

- Gross rental yield: 8-12% annually

- Tenant profile: Artists, young families, service workers

- Vacancy rates: Moderate (3-7% typical)

- Appreciation potential: High growth neighborhoods

Value Neighborhoods (College Park, Riverdale, Forest Park)

Affordable areas provide highest cash-on-cash returns:

- Studio/1BR ADUs: $1,000-$1,600/month

- 1BR+ ADUs: $1,300-$2,000/month

- Gross rental yield: 10-15% annually

- Tenant profile: Service workers, students, retirees

- Vacancy rates: Variable (5-10% typical)

- Appreciation potential: Moderate but steady growth

Property Value Impact Analysis

ADUs significantly increase property values across Atlanta's diverse real estate market.

Immediate Value Addition

ADUs typically add substantial value upon completion:

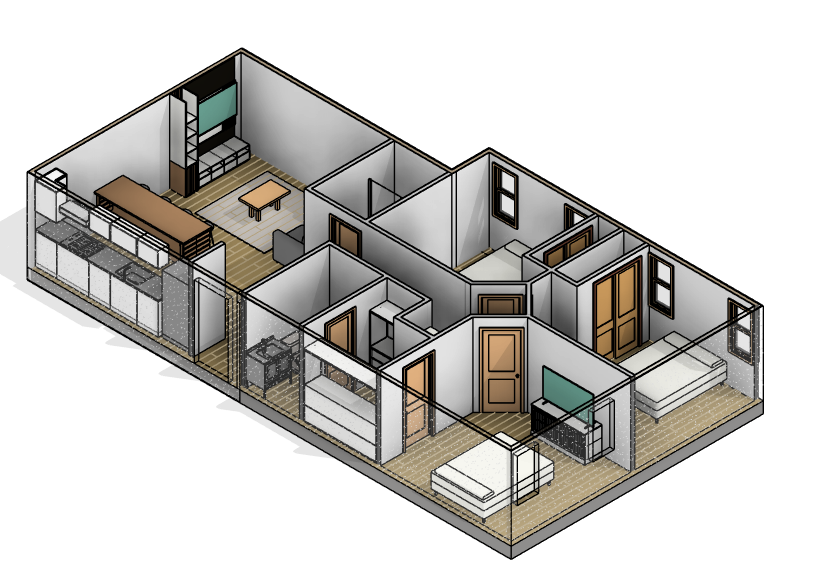

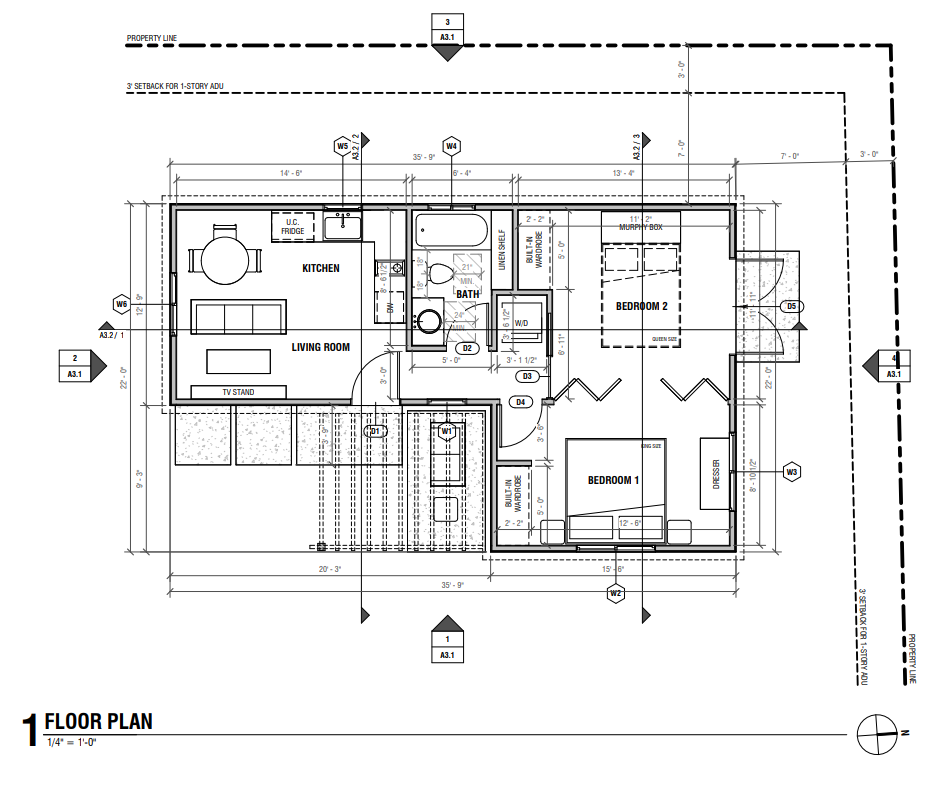

- Basic ADUs (400-500 sq ft): Add $80,000-$120,000 in value

- Mid-range ADUs (500-650 sq ft): Add $120,000-$180,000 in value

- Premium ADUs (650-750 sq ft): Add $180,000-$280,000 in value

- Value-to-cost ratio: 70-85% recovery of construction costs

- Market appeal: Properties with ADUs sell 20-30% faster

Long-Term Appreciation Benefits

ADU properties often outperform market appreciation rates:

- Enhanced appreciation: 1-2% above neighborhood averages

- Income stability: Rental income supports property values

- Future-proofing: Meeting growing demand for flexible housing

- Resilience: Multiple income sources reduce investment risk

Atlanta Market Advantage

Atlanta's permissive ADU zoning in R-4, R-4A, and R-5 districts covers most desirable neighborhoods. Unlike restrictive markets, Atlanta homeowners can capitalize on ADU investments throughout the metro area, not just in limited zones.

Financial Return Models

Different ADU investment scenarios provide varying financial returns.

Cash Purchase Investment Model

For investors with available capital:

- Investment example: $200,000 ADU construction cost

- Monthly rental income: $2,000

- Annual gross income: $24,000

- Operating expenses: $6,000 (25% of gross income)

- Net annual income: $18,000

- Cash-on-cash return: 9% annually

- Property appreciation: Additional 4-6% annually

- Total return: 13-15% annually

Financed Investment Model

Using leverage to maximize returns:

- Total investment: $200,000 ADU construction

- Down payment: $50,000 (25%)

- Financing: $150,000 at 7% for 20 years

- Monthly debt service: $1,163

- Monthly rental income: $2,000

- Monthly cash flow: $837 (after expenses)

- Cash-on-cash return: 20% on invested capital

- Total leveraged return: 25-30% including appreciation

Family Use to Rental Transition

Flexible investment approach:

- Initial use: Family accommodation (aging parents, adult children)

- Transition timeline: 2-5 years to rental income

- Tax benefits: Immediate homestead exemption advantages

- Rental conversion: Full market rent when ready

- Flexibility value: Options provide additional return

Tax Benefits and Incentives

ADU investments provide substantial tax advantages for Atlanta property owners.

Depreciation Benefits

Significant tax savings through cost recovery:

- Depreciation period: 27.5 years for residential rental property

- Annual deduction: Approximately 3.6% of ADU construction cost

- Example calculation: $200,000 ADU = $7,273 annual depreciation

- Tax savings: $1,818-$2,546 annually (25-35% tax bracket)

- Accelerated depreciation: Bonus depreciation for certain improvements

Operating Expense Deductions

Many ADU-related expenses are tax-deductible:

- Maintenance and repairs: Full deduction for upkeep costs

- Property management: Professional management fees

- Insurance premiums: Portion allocated to ADU

- Utilities: Separate or proportional utility costs

- Property taxes: Incremental tax increase from ADU

- Professional services: Legal, accounting, and other professional fees

Georgia State Incentives

Additional benefits specific to Georgia:

- Homestead exemption: Reduced property taxes on owner-occupied properties

- Energy efficiency credits: Tax credits for sustainable construction

- Historic preservation: Additional credits in designated areas

- Opportunity zones: Capital gains deferral in qualified areas

Risk Analysis and Mitigation

Understanding and managing investment risks ensures long-term success.

Market Risks

Factors that could impact ADU investment returns:

- Economic downturn: Reduced rental demand and property values

- Interest rate changes: Impact on financing costs and property values

- Regulatory changes: New zoning or rental regulations

- Competition: Increased ADU supply affecting rental rates

- Neighborhood changes: Gentrification or decline affecting values

Property-Specific Risks

Risks related to individual ADU investments:

- Construction cost overruns: Budget planning and contingencies

- Maintenance expenses: Ongoing repair and upkeep costs

- Vacancy periods: Lost rental income between tenants

- Tenant issues: Property damage or payment problems

- Insurance claims: Property damage from weather or accidents

Risk Mitigation Strategies

Professional approaches to minimize investment risks:

- Quality construction: Experienced contractors reduce maintenance issues

- Comprehensive insurance: Adequate coverage for all potential losses

- Professional management: Expert tenant screening and property management

- Financial reserves: Emergency fund for unexpected expenses

- Market diversification: Multiple properties across different neighborhoods

Investment Timing Considerations

Atlanta's current market conditions favor ADU investments, but timing matters. Rising construction costs and interest rates may impact returns. Consider locking in construction contracts and financing early to maximize investment performance.

Comparative Investment Analysis

ADU investments compared to other Atlanta real estate opportunities.

ADUs vs. Traditional Rental Properties

Key differences in investment performance:

- Capital requirements: ADUs require less initial investment

- Management complexity: Single-tenant ADUs simpler than multi-unit properties

- Financing options: Home equity financing often more accessible

- Market entry: ADUs allow entry without purchasing additional properties

- Tax benefits: Owner-occupied properties provide additional advantages

ADUs vs. Stock Market Investments

Real estate advantages over financial markets:

- Tangible asset: Physical property with intrinsic value

- Income generation: Monthly cash flow vs. dividend uncertainty

- Tax advantages: Depreciation and expense deductions

- Inflation protection: Rents and values typically rise with inflation

- Control factors: Direct influence over property performance

ADUs vs. Business Investments

Passive income advantages:

- Lower management time: Minimal daily involvement required

- Proven business model: Housing demand is fundamental

- Lower failure risk: Real estate historically more stable

- Scalability: Can expand with additional properties

- Exit strategies: Multiple options for investment liquidation

Case Study: Successful Atlanta ADU Investment

Real-world example of ADU investment performance in Atlanta.

Project Details

Virginia Highland neighborhood detached ADU:

- Location: Virginia Highland, Atlanta

- ADU size: 650 square feet, 1 bedroom + den

- Construction cost: $185,000 (completed 2023)

- Financing: $140,000 HELOC at 6.5%

- Owner equity: $45,000

Financial Performance

Two-year performance results:

- Monthly rent: $2,400 (95% occupancy rate)

- Annual gross income: $27,360

- Operating expenses: $6,840 (25% of gross)

- Debt service: $11,160 annually

- Annual cash flow: $9,360

- Cash-on-cash return: 20.8% on invested capital

- Property appreciation: $35,000 estimated increase

- Total return: 98% over two years

Investment Benefits

- Strong cash flow from rental income

- Property value appreciation

- Tax deductions and depreciation

- Inflation hedge through rent increases

- Portfolio diversification

- Potential family use flexibility

Success Factors

- Quality location selection

- Professional construction team

- Appropriate financing structure

- Market-rate pricing strategy

- Professional tenant screening

- Proactive maintenance approach

Getting Started with ADU Investment

Steps to begin your Atlanta ADU investment journey.

Investment Planning Process

Systematic approach to ADU investment success:

- Financial assessment: Evaluate available capital and financing options

- Market research: Analyze rental rates and appreciation trends

- Property evaluation: Assess your property's ADU potential

- Professional consultation: Work with experienced ADU builders

- Investment modeling: Project returns and cash flow scenarios

- Risk assessment: Understand and plan for potential challenges

Professional Team Assembly

Key professionals for ADU investment success:

- ADU contractor: Experienced Atlanta ADU construction company

- Real estate attorney: Legal guidance for contracts and regulations

- Accountant: Tax planning and financial structuring

- Property manager: Professional rental management services

- Insurance agent: Comprehensive coverage for investment protection

Conclusion

Atlanta ADU investments offer compelling returns through multiple income streams and tax advantages. The combination of strong rental demand, property appreciation, and favorable regulatory environment creates excellent investment opportunities for qualified property owners.

Success requires careful planning, professional execution, and ongoing management. With proper approach and expert guidance, Atlanta ADUs can provide superior returns compared to traditional investment alternatives while offering flexibility for changing family needs.

Ready to Explore ADU Investment Opportunities?

Our team provides comprehensive investment analysis and professional ADU construction services. We help Atlanta property owners maximize their real estate investment returns.

Contact us today for a personalized ADU investment analysis for your property.